As a Realtor®, I find myself having some pretty quirky conversations about credit scores with my clients. I get to tell stories that sound like old wives’ tales and recipes. For example: “I had some clients who were so excited about buying their first home, they went running out and bought a whole new bedroom set. They fell into the ‘No Interest for 3 Years!!!’ trap and financed their new ‘free’ furniture. They almost lost that new home over coveting a new bed.” What? Yep, your lender pulls your credit again just before they ship out the piles of loan documents for you to sign. They want to see if anyone went out and bought a new car, stopped paying their credit cards or…bought a bed.

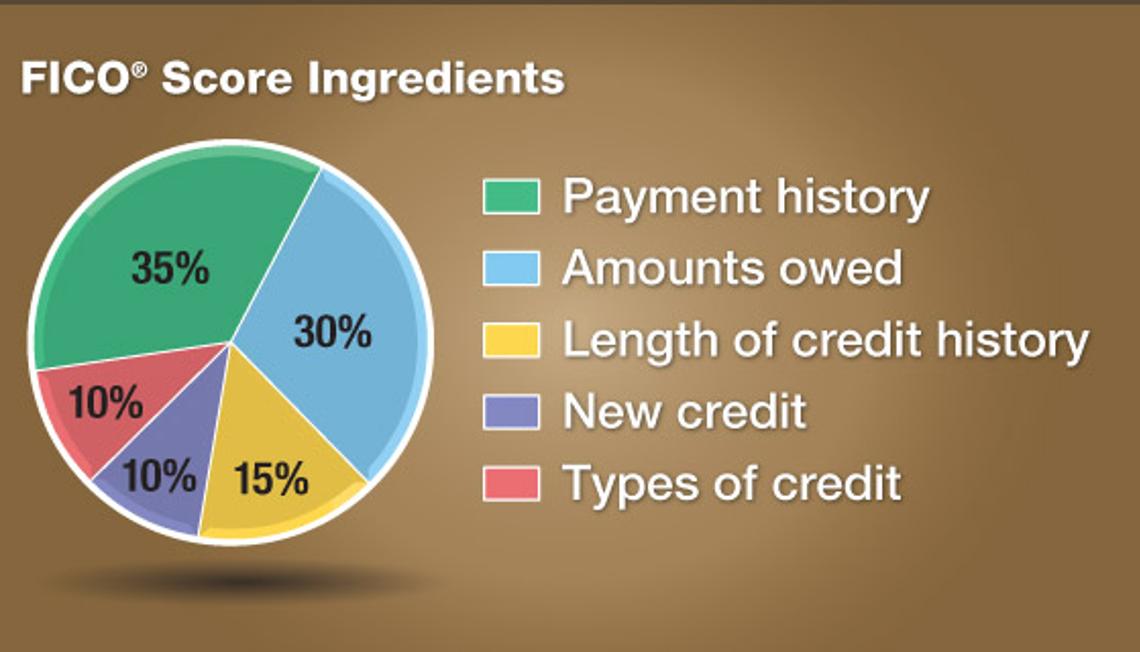

As you can see from the lovely pie chart depicted above, there are 5 ingredients mashed up into your FICO score dessert. Take, for example, the bedtime story. When my eager young buyers went to Store Credit A-Go-Go (not the real vendor’s name, the real vendor is – uh – bankrupt), they took advantage of the in-store credit option. That carves up that “15% Length of Credit History” piece and mixes it in with the “10% New Credit” ingredients of the pie. 25% of their credit score was hanging in the balance. Since they were only a few points above the threshold required for their loan qualifications, they dropped just enough to fall out of eligibility for their loan program. No dollop of whipped cream on that serving. Their lender barely had time to switch them into a different loan program so they didn’t lose their first home. They ended up paying a higher interest rate because they were deemed higher risk borrowers.

Or my funky ditty about my buyer’s new computer… “I had this buyer once who saw an ad for the biggest, baddest computer known to mankind with monthly payments of only $24 per month (on approved – wait for it – credit)”. Unlike the first scenario, she had a FICO score with plenty of room to move. Instead, she served up a heaping slice of “30% The Amounts You Owe”. When her lender pulled her credit a few days before closing, her total amount owed hopped right out of the mixing bowl into a splat on the floor. You see, boys and girls, even if you only pay $24 a month for your fancy abacus, your score says you owe the whole $3000 now. With her house on the line, she coughed up the $3000 to bring her debt ratio back into the acceptable range required by her loan’s underwriting standards.

Then there’s the new refrigerator another buyer decided she wanted to get from Lowe’s because she could get 10% off if she put it on her new, shiny Lowe’s card. That is a cholesterol- busting combo of “10% New Credit” + “10% Types of Credit” + “30% The Amounts You Owe” + “15% Length of Credit History”. Ouch.

I am chock-full of Betty Crocker greatest hits of close-call credit nightmares. Too bad I get to be the wet blanket all over my buyers’ consumer aspirations while in escrow. “Don’t buy anything. Don’t close any credit card accounts. Don’t move a muscle.”

Fair Isaac Corporation (FICO) launched a consumer education website. (www.scoreinfo.org) They came up with that fancy pie chart showing the breakdown of the factors under consideration when reporting agencies whip up your credit scores. This is not your mama’s apple pie. You should check out the recipe.

By submitting information, I am providing my express written consent to be contacted by representatives of this website through a live agent, artificial or prerecorded voice, and automated SMS text at my residential or cellular number, dialed manually or by autodialer, by email, and mail.

By submitting information, I am providing my express written consent to be contacted by representatives of this website through a live agent, artificial or prerecorded voice, and automated SMS text at my residential or cellular number, dialed manually or by autodialer, by email, and mail.